Jeff Bezos on Risk, Scale, and Thinking Long-Term

Practical Founder Lessons from Amazon, Blue Origin, and a Life of Big Bets

Jeff Bezos has built companies that require a kind of thinking most founders never attempt: decade-long time horizons, massive upfront losses, and bets where success isn’t guaranteed—or even likely.

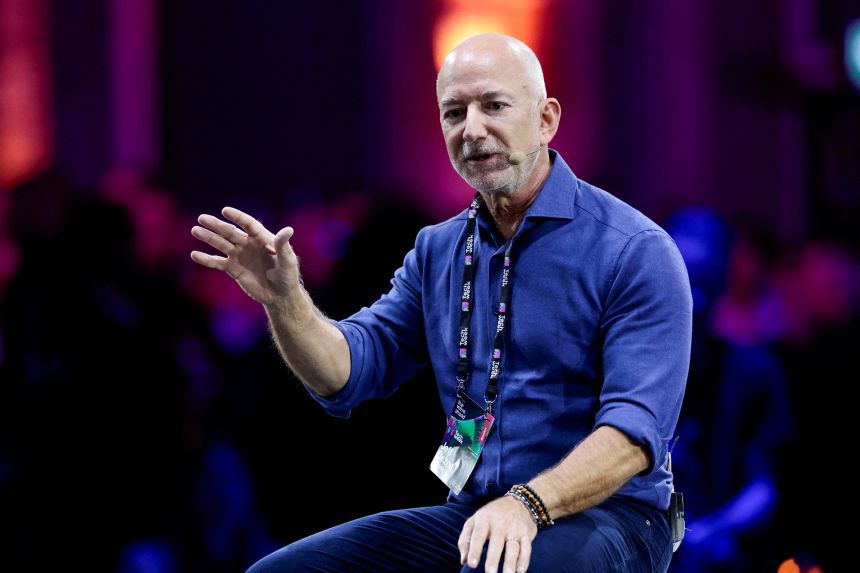

In a wide-ranging onstage conversation with Andrew Ross Sorkin at the 2024 New York Times DealBook Summit, Bezos unpacked how he actually thinks about risk, confidence, scale, leadership, and meaning. Not in platitudes, but in decision frameworks forged while losing money for 11 years at Amazon, funding rockets with his own capital, and telling early investors there was a 70% chance they’d lose everything.

For wantrepreneurs, this interview offers something rare: permission to think bigger without being reckless.

Below are the most actionable lessons founders can apply today.

1. Most Humans Overestimate Risk and Underestimate Opportunity

Bezos believes there’s a built-in flaw in human decision-making:

“I think it’s generally human nature to overestimate risk and underestimate opportunity.”

This matters because entrepreneurship is fundamentally about asymmetric bets—where downside is capped but upside is enormous.

Founder takeaway:

- When evaluating a new idea, force yourself to challenge your fear math.

- Ask:

- What’s the real downside if this fails?

- What’s the upside if this works even moderately well?

- Most founders kill ideas not because they’re bad—but because fear feels more concrete than opportunity.

Action: Write down the worst realistic outcome of your next big decision. Then write down the best realistic outcome. If the upside dwarfs the downside, you’re probably underestimating the opportunity.

2. Thinking Small Is a Self-Fulfilling Prophecy

Bezos didn’t lose money at Amazon because he was careless. He lost money because the business only worked at scale.

“Thinking small is a self-fulfilling prophecy.”

Small ambitions create small systems, small infrastructure, and small outcomes. Big ambitions force you to design differently from day one.

Founder takeaway:

- Don’t ask: “What’s the safest version of this?”

- Ask: “What does this need to look like at full scale?”

Amazon didn’t optimize for early profitability—it optimized for customer obsession at massive scale, knowing profits would follow.

Action: Redesign one core process (marketing, onboarding, product delivery) as if you were serving 10x your current customers. You’ll immediately see where your thinking is constrained.

3. Confidence Isn’t Certainty—It’s Comfort With Probability

One of the most misunderstood parts of Bezos’ success is confidence. Early on, he told investors Amazon had a 70% chance of failure.

“It’s not a fear that it can’t work. It’s a fact that it might not work.”

That statement didn’t weaken his conviction—it clarified it.

Founder takeaway:

- You don’t need certainty to act.

- You need conviction despite uncertainty.

Founders who wait until they “know it will work” never start. Founders who accept probabilities move forward faster and learn sooner.

Action: For your next initiative, assign an honest probability of success. If the expected value is positive, proceed—even if the odds aren’t great.

4. Big Businesses Take Time—And That’s Not a Bug

Amazon lost money for 11 straight years. Blue Origin still isn’t a “good business” yet, by Bezos’ own admission.

“It’s a business. It’s not a very good business yet.”

Most founders secretly hope for outsized results on startup timelines. Bezos builds on civilization timelines.

Founder takeaway:

- If you’re building something meaningful, early discomfort is normal.

- Long-term thinking is a competitive advantage precisely because most people can’t sustain it.

Action: Ask yourself: Am I building for the next funding round—or the next decade? Then align decisions accordingly.

5. Messy Meetings Beat Polished Presentations

Inside Amazon, Bezos discouraged rehearsed meetings:

“Internally, you’re seeking truth, not a pitch.”

Polished presentations optimize for approval. Messy discussions optimize for insight.

Founder takeaway:

- Create environments where dissent is safe.

- Invite disagreement early—before ideas harden.

Bezos even structured meetings so junior voices speak first, preventing senior opinions from anchoring the room.

Action: In your next team meeting, explicitly ask: “Who disagrees, and why?” Then sit with the silence until someone answers.

6. Emotional Precision Is a Leadership Skill

One of the most surprising moments came when Bezos spoke about fear:

“I’ll say in meetings, ‘I’m scared.’ That’s more precise.”

Rather than masking emotion, he uses it as diagnostic data.

Founder takeaway:

- Emotions are early warning systems, not weaknesses.

- Naming fear clearly leads to better problem-solving than hiding it behind anger or bravado.

Action: Replace vague frustration with specificity. Instead of “this worries me,” articulate what and why.

7. The Goal Isn’t to Be Understood, It’s to Be Useful

Bezos has given up trying to control public perception:

“I gave up on being well understood a long time ago.”

For founders, this is liberating. Energy spent managing optics is energy not spent building.

Founder takeaway:

- Focus on creating value, not defending narratives.

- If you’re doing meaningful work, misunderstanding is inevitable.

Action: Identify one place you’re optimizing for perception instead of progress—and let it go.

Final Thought: Play Long Games With Long-Term People

At his core, Bezos doesn’t see himself as a billionaire or executive. He sees himself as an inventor.

“I wake up every day and follow my curiosity.”

That curiosity—combined with patience, honesty about risk, and willingness to think at scale—is what separates enduring companies from short-lived wins.

For wantrepreneurs, the lesson is simple but hard:

Think bigger. Wait longer. Be honest about risk. And don’t confuse fear with wisdom.